The federal government is failing Canadian health research

Canada risks losing out by inadequately investing in health researchers working to unlock new discoveries.

ArriveCan accountability remains top question as federal spending watchdog says she found ‘disappointing failures’ everywhere she looked

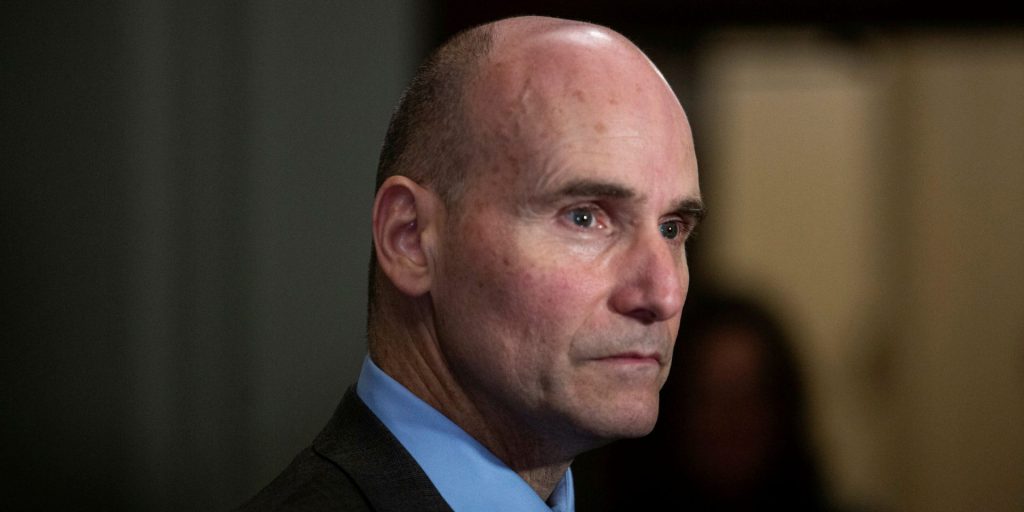

Canadians will lose faith in institutions if there are no consequences, says Aaron Wudrick. But it should be bureaucrats—not ministers—who wear the procurement failings, according to former PSPC ADM Alan Williams.

Build houses, build culture, build community

We urgently need a national funding strategy for cultural venues, and Canadians need to rethink how we invest in cultural infrastructure post-pandemic.

Canadians want more control over their data: the case for consent-centric open banking

In a survey commissioned by Interac for Data Privacy Week, 77 per cent of respondents said that they feel that their personal data is more exposed than ever before.

ArriveCAN: CBSA’s internal review found evidence supporting allegations of misconduct

Michel Lafleur, CBSA’s executive director of professional integrity, revealed that the department had found some evidence warranting further inquiry.

Corporations are not empowered by law to ignore the environment

Surprisingly, the whole notion that the primary obligation of directors is to shareholders is a relatively new idea.

Ombud review into ArriveCan saga unveils deep-rooted issues in Canada’s procurement system

Perception is important in the business of contracting, says expert Alan Williams, and recent revelations about the $54-million ArriveCan app are ‘muddying the waters.’

Lowering the interest rate of instalment loans is the right thing to do

As a result of being trapped in a high-interest debt loan, people report going without basic necessities, lapsing on other bills, losing retirement savings, skipping important medical visits, and more.

Road to Budget 2024 must be paved with bold, long-term housing fixes for all Canadians

One way to preserve and expand the inventory of affordable housing is through the creation of a federal housing acquisition fund.

Procurement ombud’s report reveals discrepancies in ArriveCan’s $54-million contract

Mandatory criteria used in ArriveCan application procurement were ‘overly restrictive’ and ‘favoured’ GC Strategies Inc. as an existing CBSA supplier, which led to the awarding of a $25-million contract to the company in the centre of misconduct allegations.