Time is ripe to revamp federal budgeting processes

Finance Minister François-Philippe Champagne’s post-election announcement that no federal budget would be tabled this spring, and would instead be delivered in the fall, set tongues wagging this past May. Criticisms came from all corners of the House, but subsequent opposition attempts to force Prime Minister Mark Carney’s government to table a spring spending plan came […]

Carney government has two duties to younger Canadians, and one is to offer real hope

First, it must closely monitor employment and housing trends for younger Canadians as it sets economic policy, and second, it must show that the system works for them, too, and they can have their own Canadian Dream.

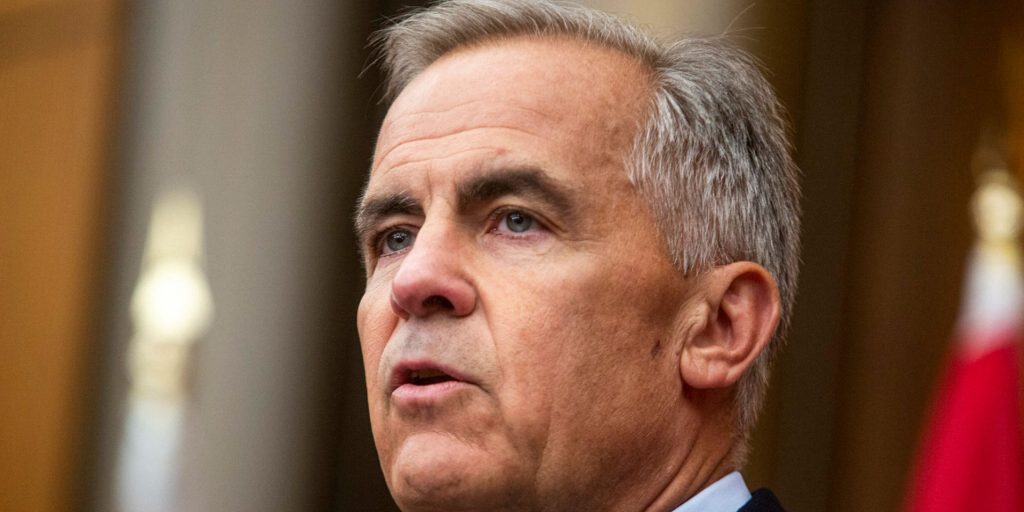

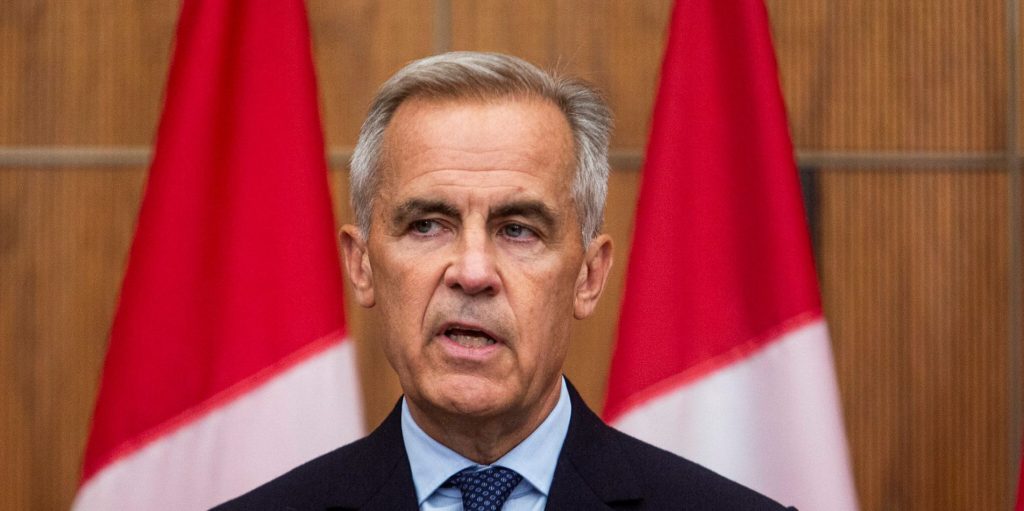

Carney’s budget expected to be ‘consequential,’ as Canada faces unprecedented challenges from a volatile Trump, say politicos

Perrin Beatty, former president of the Canadian Chamber of Commerce, says the government needs to give a clear indication to businesses what its plans are, and expects there will be some pretty tough news, as Canada’s fights a trade war with the U.S.

Carney will need to prove he can actually stand up to Trump, he campaigned on it

The United States holds tremendous economic leverage over us. For now, Canada is protected by the existing North American trade agreement and most of our exports to the U.S. are tariff-exempt. But the agreement will soon be renegotiated and that’s when the U.S. will apply real pressure.

Canada ‘should not relent’ in trade talks, say industry reps who say auto sector needs zero tariffs

No level of tariff is good for Canadian prospects and jobs in the automotive sector, according to Flavio Volpe, president of the Automotive Parts Manufacturers’ Association of Canada and a member of the prime minister’s Council on Canada-U.S. Relations.

U.S. trade approach ‘changes the rules of the game,’ with canola sector leading economic lobbying in first six months of 2025

Troy Sherman, with the Canola Council of Canada, told The Hill Times that changes to global trade caused by U.S. President Donald Trump is requiring exporters to throw out the old playbook and rethink their approach to trade: ‘we’re seeing a fast-changing geopolitical landscape.’

A strong economy depends on a strong social sector

We must invest in the social infrastructure that supports essential community services that return value to the economy and to communities.

WAGE isn’t in a funding crisis—it has a design flaw

Women and Gender Equality Canada’s latest funding forecast has sparked panic, but for all the wrong reasons. The gender equity sector must zoom out, stop reacting to fear, and push for a complete overhaul of how funding is structured.

House Finance Committee faces pre-budget time crunch ahead of fall tabling

The amount of influence the House Finance Committee can have on a government budget is debatable, say observers, who note the fall schedule could provide an opportunity to adjust the process.

Trade, housing, prosperity: none of it happens without construction

The truth is this: if the government wants to build the economy of the future, they need to partner—urgently and seriously—with the sector that physically builds it.