Winners and losers you might have missed in the federal budget

Prime Minister Mark Carney plans to run a deficit in the tens of billions of dollars for years to come, but despite his warning against coming sacrifices, they were few and far between in the Nov. 4 document.

Is now the winter of our economic discontent?

It is quite evident that we are barrelling towards economic gloom, and creating a society of haves and have nots.

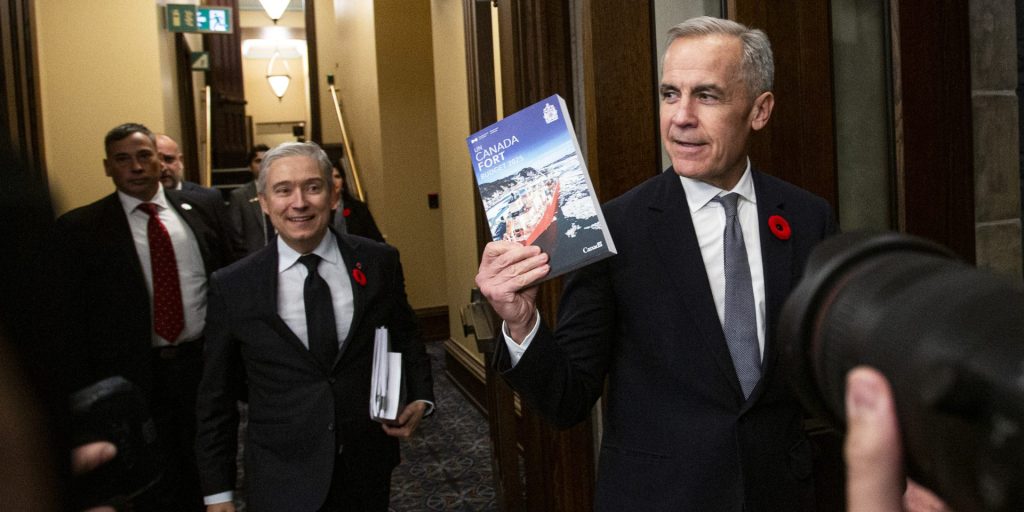

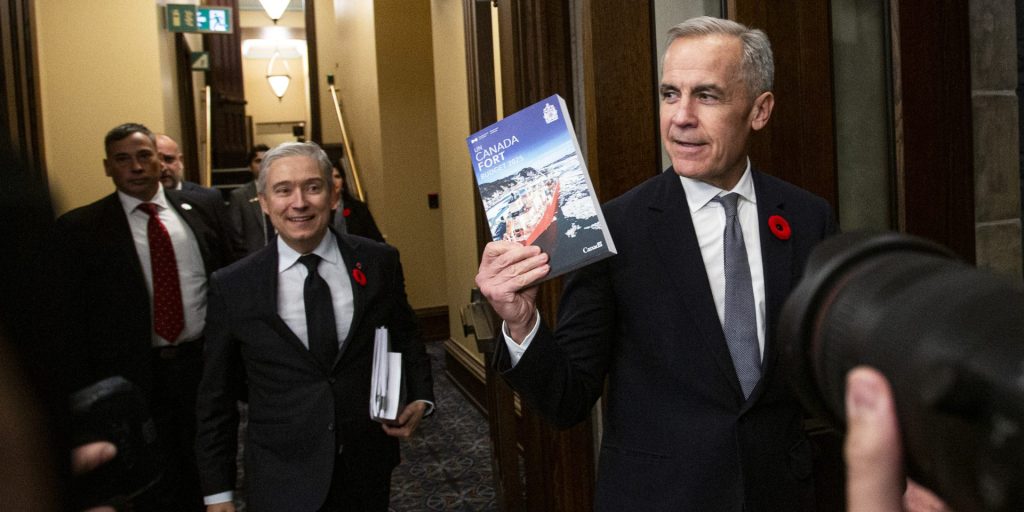

Carney Liberals table long-awaited budget

The Hill Times

Carney rewrites the Liberals’ vision in a pro-growth budget for a post-NAFTA era

The historic budget will forever mark the end of Canada’s era of economic integration over 75 years with its erstwhile U.S. ally.

Read the speech: Champagne tables first budget to ‘weather the storm’

The finance minister called the budget ‘a generational plan’ investing $280-billion in capital over five years to address a time of ‘profound change.’

Tax incentives for companies hiked to attract investments, but economists say budget not ‘transformational’ enough for businesses

Budget 2025 has reinstated the program that allows businesses to write off their capital assets in the first year of purchase, saving them on corporate taxes that year.

Carney cuts international student quota in half

The budget outlines plans to halve the number of foreign student permits to 155,000 in 2026, 2027, and 2028—down from the past target of 305,900 new arrivals for 2025.

Carney government promises to spend $81.8-billion over five years on defence

The funding boost is a part of Canada’s commitment to meet spending targets set by NATO.

Carney Liberals focus on health infrastructure, but no new funding for mental health, substance use programs in budget

A number of health programs—including the Emergency Treatment Fund—will expire in 2026-27, delaying decisions for some programs into the future.

Departments to cut billions in spending as budget projects tens of thousands of federal public service job losses by 2029

The federal public service is expected to employ roughly 330,000 people by 2028-29, down 10 per cent and 40,000 jobs compared to 2023-24. The budget says these numbers will be achieved by normal attrition through retirement, voluntary departures, and the Carney government’s spending review.