Budget signals strong economic focus, but falls short in details like regulatory burden or clarity on defence spending, say experts, economists

‘There’s an urgency that if we don’t go big, then we’re going to fall short,’ says Goldy Hyder, president and CEO of the Business Council of Canada.

Budget 2025 is more of the same

The budget has positive measures, but it fails to provide a credible plan for the future. What is the Carney government’s vision for the future?

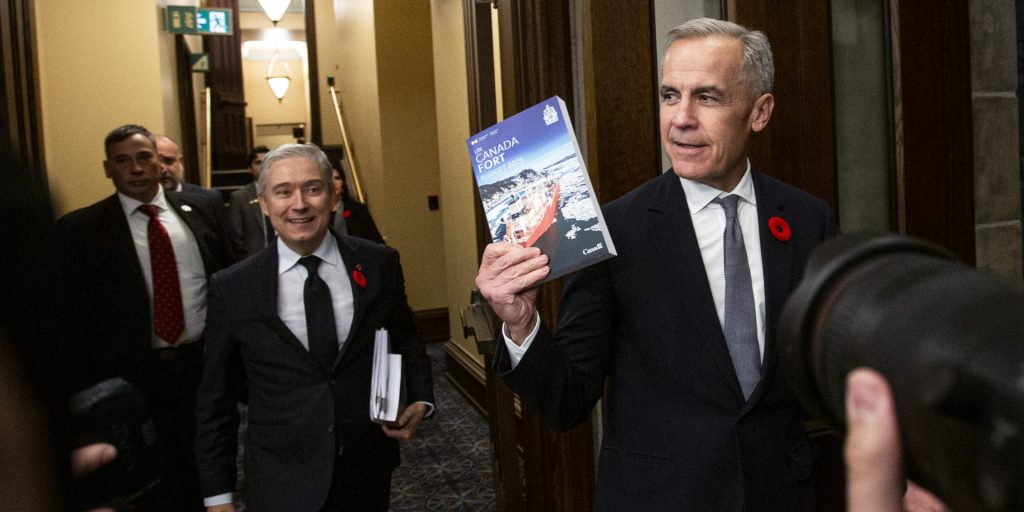

A budget that meets the moment

The financial plan tabled on Nov. 4 it is a statement of intent that Canada will compete, build, and lead as a strong, secure, and sovereign nation.

Canada’s foreign aid budget cuts hurt global health

The $2.7-billion cut places Canada’s reputation in jeopardy on the world stage, and will leave the most vulnerable to simply fend for themselves.

Canada at a crossroads as history repeats itself

We have not learned the lessons of 1995, when that NAFTA era budget dramatically reduced social spending and gutted the civil service. Once again, Canada is meeting a moment with a budget that abandons people and the environment to fuel corporate growth.

Potential PCO intelligence cuts ‘counterintuitive and risky,’ say national security experts

The government’s effort to find savings by scrapping duplication risks undermining the country’s limited analytical capacity, says Stephanie Carvin.

Liberals’ ‘quiet confidence’ the best move as budget ‘dominoes’ fall with the Conservative caucus count, say politicos

‘If you’re the Liberals, you let this play out,’ and don’t get in the way of any opposition mistakes that may ultimately ease the passage of the budget, says Summa Strategies’ Tim Powers.

MPs to vote on $10.8-billion spending boost in new estimates

The Canadian Dental Care Plan will receive the largest portion of the funds at $1.6-billion, with Indigenous Services, Crown-Indigenous Relations, and National Defence each requesting over $1-billion.

Proposed collective bargaining changes could ‘influence the opinions of arbitrators’ to consider feds’ fiscal situation: lawyer

The budget outlines plans to update the Federal Public Sector Labour Relations Act, which federal unions are criticizing as ‘vague’ and ‘concerning’ for its potential to infringe on workers’ rights.

Feds focused on ‘streamlining’ programs, says health minister after budget fails to provide new money for mental health or substance use

Health Minister Marjorie Michel says that funds remain available through existing bilateral agreements and the Emergency Treatment Fund.